Case Study

Trading Evolution: From Bots to AI Hedge Fund

How simple crypto bots evolved into a 9-agent autonomous trading system

The journey from single-strategy RL bots to multi-agent consensus trading. Three generations of autonomous trading systems, each building on lessons from the previous: Trading Agents → Chimera → Agora Quantum.

!The Single-Strategy Trap

My first trading bots used reinforcement learning with fixed strategies. They worked—until market conditions changed. A momentum strategy that printed money in bull markets hemorrhaged in sideways markets. Single-model systems have blind spots.

- Single strategies fail when market conditions change

- No mechanism to challenge or validate trading decisions

- RL models overfit to historical patterns

- Human bias encoded into strategy selection

Evolutionary Architecture

Each generation learned from the previous. Trading Agents proved autonomous execution worked. Chimera added multi-LLM voting to reduce single-model bias. Agora Quantum introduced structured debate with specialized agents representing different investment philosophies.

- Gen 1 (Trading Agents): RL-based crypto bots, $500 capital, Raspberry Pi execution

- Gen 2 (Chimera): 3 LLMs (Grok, Gemini, Claude) voting on crypto trades, 90% cost reduction via caching

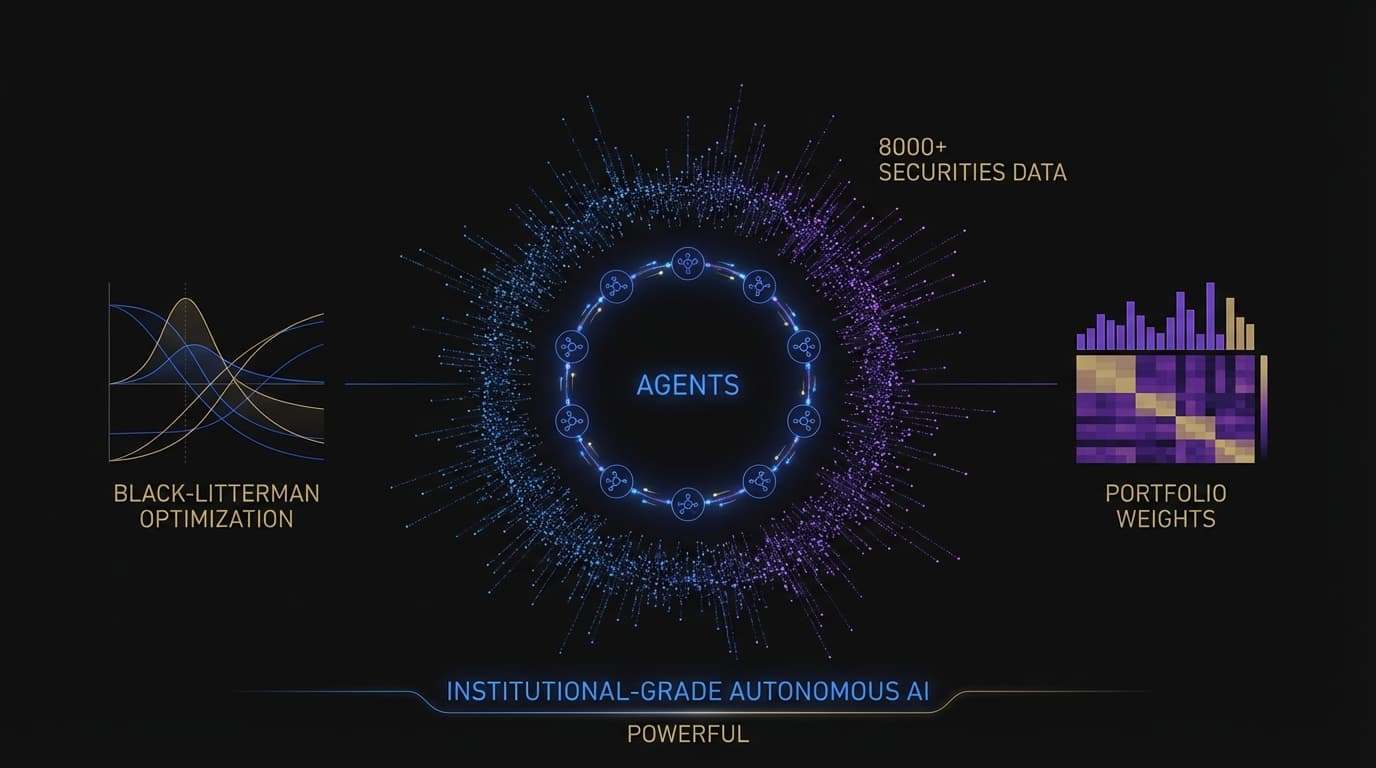

- Gen 3 (Agora): 9 specialized agents, 3-round debate protocol, 8,000+ securities coverage

- All generations: Running 24/7 on Raspberry Pi (~$50 hardware)

Architecture

The architecture evolved from single-model inference to multi-agent orchestration. Each generation maintained the core principle: cheap hardware, sophisticated software.

Timeline

Key Lessons

Single-strategy systems are fragile; multi-perspective systems are antifragile

Structured debate surfaces insights that consensus voting misses

Cheap hardware + sophisticated software beats expensive infrastructure + simple software

Each generation must solve the problems the previous generation revealed

LLM diversity (different models, different philosophies) reduces correlated failures