Case Study

Agora Quantum: Autonomous AI Hedge Fund

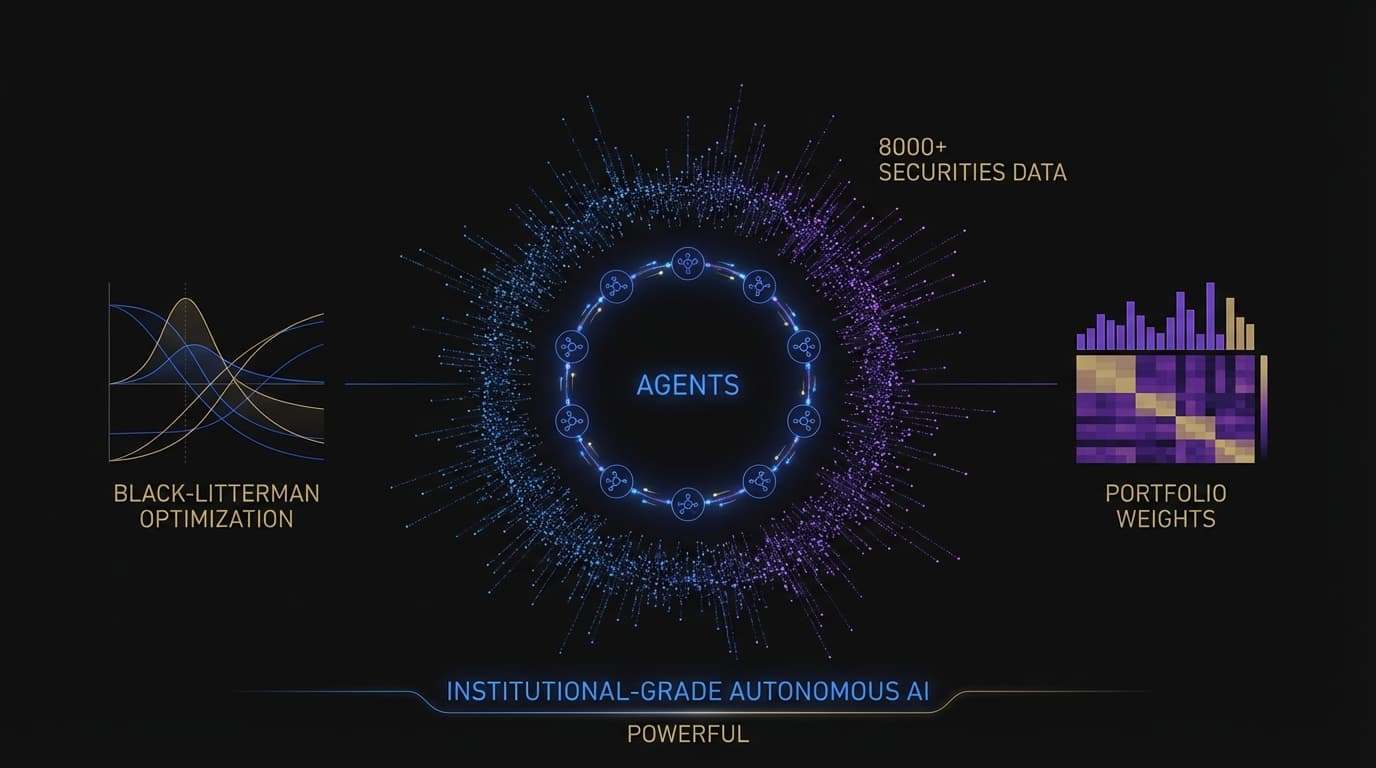

9 agents debating over 8,000 securities daily

A fully autonomous trading platform where specialized AI agents with distinct investment philosophies debate positions through structured rounds. Running 24/7 on a Raspberry Pi.

!Single-Model Bias

Traditional AI trading systems use one model with one perspective. But markets are complex—different strategies work in different conditions. A single viewpoint creates blind spots.

- Single-model systems missing diverse perspectives

- No systematic debate or challenge of positions

- High infrastructure costs for sophisticated trading

- Lack of transparency in AI decision-making

Multi-Agent Consensus

Nine specialized agents with distinct investment philosophies debate through three structured rounds. Trades only execute when multiple perspectives reach consensus.

- 9 agents: 4 Analysts, 2 Researchers, 1 Trader, 1 Risk Manager, 1 Fund Manager

- 3-round debate protocol with structured challenges

- Black-Litterman portfolio optimization

- Running entirely on Raspberry Pi

Architecture

The system uses LangGraph for agent orchestration with PostgreSQL for state and Prometheus for monitoring.

Timeline

Key Lessons

Multi-agent debate surfaces insights single models miss

Structured consensus prevents overconfident positions

Sophisticated AI doesn't require expensive infrastructure

Transparency through debate logs builds trust in autonomous systems